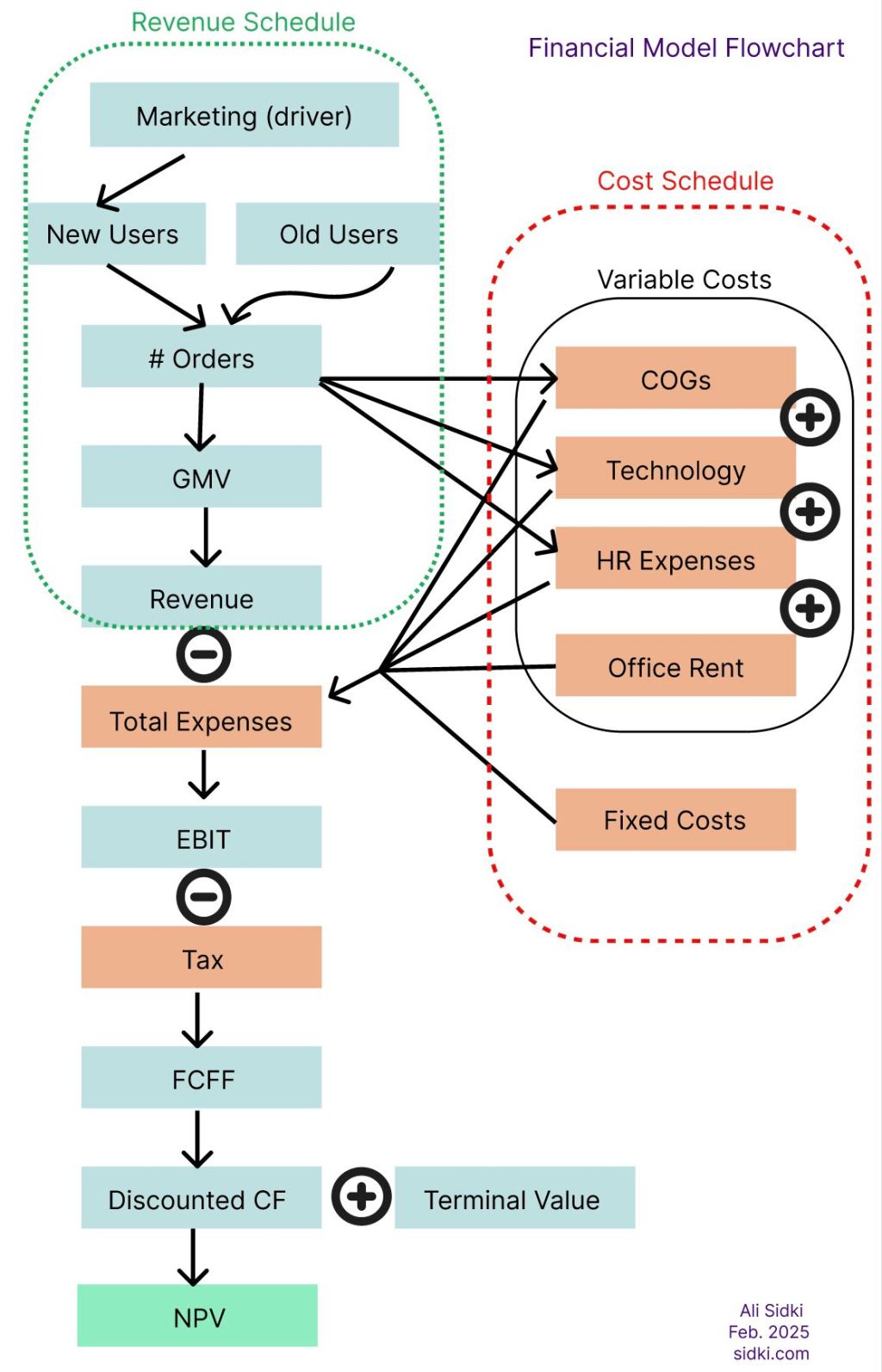

🎯 Just wrapped up a fascinating startup valuation (post commercialization stage) where marketing spend emerged as the crucial revenue driver.

Here’s what caught my attention:

• Direct correlation between marketing budget and customer acquisition

• Clear impact on revenue growth trajectory

• Scalable and measurable metrics that investors love

Instead of traditional metrics like store/branch count or salesforce size, digital-first startups often show stronger ties between marketing spend and revenue generation.

🎯 The multiplier effect was impressive: $1 in marketing → $4 in revenue (12-month period)

💡 Key learning: Identifying the right business drivers isn’t just about following industry standards – it’s about understanding what truly moves the needle for YOUR specific business model.

💭 What’s the most unexpected business driver you’ve encountered in your valuations? Drop your experiences below!

#Startups #Valuation #FinancialModeling

#Entrepreneurship #BusinessDevelopment #Investment #PitchingTips #BusinessStrategy #CorporateDevelopment #VentureCapital #StartupGrowth #StartupAdvice